You know what, 2.5 quintillion bytes of data has been created on a daily basis for the past few years which makes for approximately 90% of data in the world.

In the modern world, this large amount of data is not referred to as Big Data but the process of analyzing this data to find out patterns and all is called Big Data and when massive volume and size of the data, which is beyond the capability of traditional databases to collect than data analytics comes in the picture.

If we have to pick one industry out of the 147 industries which exist (as according to LinkedIn) which took the most benefit of data analytics then the answer would be the financial industry.

Well, Let’s Look into Some Statistics First

- In the upcoming years, the highest investment of 28% banks and other financial institutions will be in big data and analytics as per IDC survey.

- Compared to 2018, there is an increase of 12% ($189.1 billion approx.) in the solutions by big data and analytics. This figure is forecasted to be double in 2022.

- A report from the International Data Centre shows that big data analytics revenue will grow up from 2018 to 2022, with the annual growth rate of 13.2% and the projected revenue for 2022 to be 274.3 billion

Importance of Data Analytics in the Financial Sector at a Glance

As there is the immense value of customer retention in the B2B and B2C markets, banks also know the value of customer retention and customer loyalty.

So, for more understanding of these tricks, to keeping customers in touch, banks and other financial institutions including the insurance sector are taking a proactive approach which includes the introduction of big data analytics in their industry.

Below are some points listed to give an overview of the importance of data analytics.

Surety of Growth and Better Customer Targeting

By analyzing the data of their customers properly, banks and other institutes will understand their trading behaviors via their routine transaction volume.

Let’s say, if banks observe any reduction in the transaction volume they can then offer them better deals (e.g. lowered interest rates) and this might result in higher retention and attainment of a better segment of customers.

Better Marketing of Newly Designed Products

Financial institutes are taking full advantage of big data analytics for targeting the intended customers as we discussed above and with the help of this approach they are designing better products that match the wants, needs, and demands of customers for present and as well as for the future.

Let’s now discuss the importance of data analytics in-depth for various major financial institutions like,

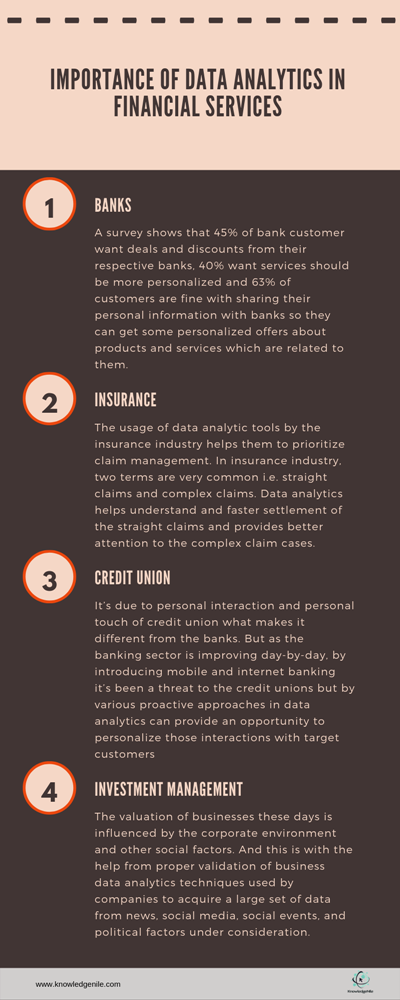

How Data Analytics Proves to be Beneficial across Different Financial Sectors

Banks

Risk Prediction

Because of data analytics, banks are able to access the risk profile of credit applicants in detail, with the help of which they can improve their credit assessment policies.

The most important feature of data analytics is an advanced warning system that helps banks to reduce their risk cost and become more aware of the fraudulent cases much earlier.

Enhancing the Power of Decision Making and Productivity

With the help of proper analysis using data analytics tools, banks are able to provide a crisp and accurate response to the customer within a short span of time. More refined data helps the bank in easy decision making for day-to-day activities.

Let’s say without data filtration or unstructured data, it would have been a really hectic activity for banks to set up an ATM at the right place, placing numbers of the counter for customer services, and to decide which ATM machine required what amount of cash.

But with different analytics tools, this is possible for banks to understand and to make decisions accordingly.

A Personal Touch for Every Customer

In the case of better customer experience and customer personalization, the retail sector will always be ahead of every other industry.

Banks and other financial sectors are also taking notes from the retail industry when it comes to “customer experience and personalization”.

Approaches like Tap and Go, product suggestion based on the purchasing history, and creating an offer based on geographical data and seasonal sales are some of the tricks that retailers understand way before the other industries.

Many of the bank customers also want and expect similar kind of services from their banks. A survey shows that 45% of bank customer want deals and discounts from their respective banks, 40% want services should be more personalized and 63% of customers are fine with sharing their personal information with banks so they can get some personalized offers about products and services which are related to them.

Insurance

Improving Claim Management

The usage of data analytic tools by the insurance industry helps them to prioritize claim management. In the insurance industry, two terms are very common i.e. straight claims and complex claims.

Data analytics helps understand and faster settlement of the straight claims and provides better attention to the complex claim cases.

Reservation for Losses

Whenever a claim is reported it’s really difficult to understand its size, duration, and complexity. But in these kinds of scenarios, forecasting claims and calculating accurate loss is a must, especially in cases of long-tail claims like liability and workers' compensation.

But by proper analytics calculations of loss by comparing a loss with similar claims have become easy with the help of data analytics tools.

Afterward, whenever your insurance claim date is updated by your insurance company, at that time analytics tool re-assesses the loss reserve, which gives you an idea of how much money you need for your future claims.

Credit Union

Increase Membership

There’s an old saying that everyone should help other people and on this very theory, credit union was created many years back. It’s due to personal interaction and personal touch of credit union what makes it different from the banks.

But as the banking sector is improving day-by-day by introducing mobile and internet banking it’s been a threat to the credit unions but various proactive approaches in data analytics can provide an opportunity to personalized those interactions with target customers and make them feel connected by individual attention.

This will make a difference and an increase in membership.

Increase in Target Customer and Their Loyalty

With the help of analytics tools, it’s easy to find out the members who need the product or services as per their buying behavior (after analyzing the person profile).

Once it is pointed out then it’s easy for them to approach the particular targeted member within time. If we dig down deep we can understand, a customer can only be loyal when you provide royalty to them and it is by customizing the approaches to deal with the customers that you can have loyal and satisfied customers.

Multiple analytics programs make you aware of the competitors i.e. banks and provide you windows of opportunities.

Investment Management

Discovering Valuation

Recently developed analytics tools make us properly aware of the fact that the company’s valuation just does not depend on financial statements and figures.

But in-fact the valuation these days is influenced by the corporate environment and other social factors. And this is with the help of proper validation of business data analytics techniques used by companies to acquire a large set of data from news, social media, social events, and political factors under consideration.

These factors then provide the real value of the company and on the basis of that, it can be judged whether the investment is going to be profitable or not.

Profitable Investment

As we all know that from the last few odd years e-commerce is on a great high due to web traffic, which makes it a point of major consideration for different industries.

Due to which more and more companies are shifting their offline transaction business to the modernized online transaction via different portals and gateways.

Under these kinds of situations, data analytics plays a crucial role by effectively visualizing the web traffic and its impact on real-time market share so for the investor it’s easy to decide whether to invest in a particular company or not.

Leading Tools for Data Analytics

1. Apache Hadoop

Apache Hadoop is known as a pinnacle for huge-scale data processing. This is an open-source for Big Data framework and can be operated via the cloud and the need for hardware requirements, here is very low.

Features:

- HDFS — Hadoop Distributed File System is compatible with huge-scale bandwidth.

- MapReduce — a highly adjustable model for Big Data processing and filtration.

- YARN — Internal feature of tool which allows the resource to schedule its work and resource management for the top level.

- Hadoop Libraries — allows third-party modules to work with Hadoop.

2. Splice Machine

Splice Machine is a useful big data analytic tool and its architecture is accessible across multiple public clouds such as Azure, AWS, and Google.

Features:

- It can powerfully scale from a couple to a large number of nodes to empower applications at each level.

- Reduces the interference of management, quicker to use, and reduce the risk factor

- Consumes quick streaming information, creates, tests and sends AI models

3. Plotly

This tool is used to create charts and dashboard to share the content online

Features:

- Once you upload the data, it can easily turn it into an eye-catching and informative graphic.

- Best for data provenance, as it provides audited industries with their deeply analyzed information.

- You can host unlimited public files through its free community plans.

Infographic Depicting the Importance of Data Analytics in Financial Services

Conclusion:

From the last few decades, Big Data has been a prime source of growth for many industries but it holds a special value when it comes to the financial sector.

Banks, credit unions, investment management, and many more firms are investing a ton lot of money on analytics and analytical tools for improving business analysis processes.

Also Read: Open Source Data Lineage Tools for Data Management