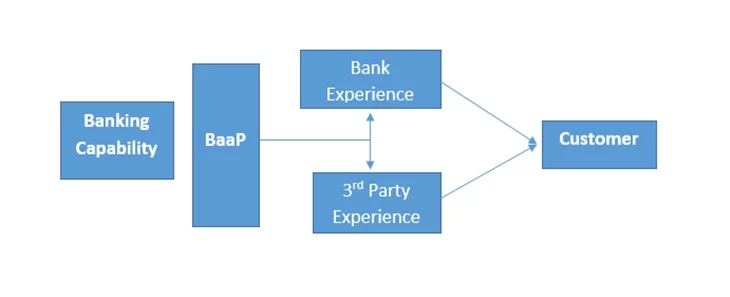

In the last few years, we have seen a tremendous shift towards cloud services and especially the emphasis on the use of services as means of a platform. Financial services are no exception to that. Most of the banks have opted to move most of their services to “Banking as a Platform.

Schematic Representation of Banking as a Platform

Many of us are wondering, “What does Banking as a Platform actually mean? How does it work? And how does it help the banks?

Let’s take a look at banking as a platform examples to shed further light on how these services helped various banks across the world.

Banking as a Platform Examples

Banking as Platform is an end-to-end on-demand service, which is provided over the web. The process involves moving the banking services to subscription-based platform services hosted over the web.

These services ensure a secure yet fast process approval which helps the banks to focus on customer personalization and improving overall banking experience.

Banking as a Platform (BaaP) opens up an opportunity for innovations that can help the banks to improve their customer experience, ease the banking operations, and ultimately become tech-savvy like their customers.

Legence Bank, headquartered in Eldorado, Illinois, has always given improving customer relationships, a high priority.

They partnered with CSI to utilize banking platform opportunities to provide their customers with a 360-degree view of banking experience.

The main problem for a small bank like Legence was to provide this service at a cheaper cost than the big multinational banks.

Legence could afford to provide the customers the platform services like CSI CRM, mobile banking platforms, and connected baking platform at cheaper costs than many of their competitors with the help of CSI’s tech experience.

Live Oak Bank, headquartered in Wilmington, North Carolina, has partnered with Plaid to provide their customers with a secured & speedy branchless banking.

The bank partnered with Plaid to address the two key issues, namely security and speed. In the age of digital transformation, their conventional security measure was not adequate enough to tackle the modern-day security breaches.

But, at the same, the bank wanted to reduce the time required to authenticate the users. Plaid helped them to reduce this time from 4 days to a single day.

The integration with Plaid was rolled out within eight weeks, and it helped the Live Oak Bank to compete with national banks as well as the big multinational banks.

Furthermore, this integration with Plaid has helped the bank to improve the customer experience tremendously and also made the banking easier for its customers.

Wells-Fargo, a San-Francisco based banking giant, is well-known for its use of technology. It was one of the pioneers in using banking as a platform, and many local banks have followed their approach.

Wells Fargo used the software platforms to reduce customer acquisition costs by a significant margin and enhance their customer experience.

The bank has also implemented an open banking platform with APIs to improve their online security and improve the authentication process.

Development Bank of Singapore, which is more commonly known as DBS, is headquartered in Singapore and has branches all across the world.

It is one of the world leaders in the banking sector and has a remarkable track record in using API technology platforms to improve its service, reducing customer acquisition costs, and ultimately improving customer experience.

As per the last update of July 2018, their banking platform adds up to 155 different APIs for different functionalities.

They have also partnered with different companies for their APIs to improve the cashless experience.

DBS has also provided its APIs for automated compliance platforms, AI Chabot services, and mobile push notifications.

The use of API based banking platforms has enhanced the tech-savvy reputation of DBS furthermore.

CBW Bank, headquartered in Weir, Kansas, is a small bank that provides corporate and retail banking services.

The bank has transformed itself by using technological transformations to their advantage.

They also won the Celent Model Bank 2017 Award for Banking as a Platform for the best use of APIs.

But, this journey to such a sustainable digital bank model was not easy. CBW bank knew the challenges that lied ahead of them.

These challenges mainly contained lack of API support for account configuration, lack of options to embed compliance, risk scoring, and risk assessment.

CBW overcame these challenges by building a sustainable digital model which has more control and greater flexibility to accommodate the third party solutions without hampering the security.

They built a digital platform with a single API, which acted as an integration point for other APIs to eliminate the challenge of connecting endless points and complicating the process.

The use of Banking as a Platform with the help of Yantra technologies has helped CBW Bank enormously.

FIDOR Bank, headquartered in Munich, Germany, built the banking platform from scratch in 2015. It is one of the first neobanks (100% Digital banks that reach the customers through mobile apps and computer platforms only) with a banking license.

Their banking platform provides the customers, a unique experience with the comprehensive package of financial products and services.

FIDOR Bank was launched back in 2010, with the motto of “banking mit freunden" which translates as "banking with friends".

Its primary aim was to make banking a fun activity to improve customer engagement.

The bank developed a fidorOS platform to be more agile and flexible and ultimately achieve greater customer personalization.

The use of the banking platform drove the customer acquisition costs down to €5 from as high as €150-€165.

JB Financial Group, based in Jeonju-si, South Korea, was the first Asian bank to integrate the banking platforms with the help of a third-party tech firm.

Their tech team developed a JB Open Bank Platform (JBOBP), which provides flexible, comprehensive, and customizable architecture to address the modern-day technological needs.

JBFG's open-source platform allows integration with Jason, Karaf, and many other big data tools.

This project has benefitted the bank to improve the customer experience and drive customer acquisition costs significantly.

Future Scope of Banking as a Platform

The financial industry is adopting the digital revolution and integrating artificial intelligence and machine learning in their banking platforms.

The future of banking platforms looks to be focused on delivering higher customer personalization and improving security to prevent cyber-attacks.

You May Also Like to Read: